BTC Signals Pro | Bitcoin Trading Alerts & Market Insights

BTC Signals Pro | Bitcoin Trading Alerts & Market Insights

Alright, earnings season. It's the time of year when companies either validate their lofty valuations or crash back down to earth. This week, Figma, The Trade Desk, and Airbnb are all under the microscope. I'm going to zero in on The Trade Desk (TTD), because frankly, the narrative around it is starting to smell a little fishy.

For years, The Trade Desk was the darling of ad tech, consistently exceeding expectations. Thirty-three straight quarters of meeting or exceeding forecasts—that's a hell of a run. But the streak broke earlier this year, and they stumbled again two quarters later. A pattern? Possibly. But let’s dive into the numbers.

The recent third-quarter results did beat expectations: $739.4 million in revenue, a 17.7% year-over-year increase. They're even projecting $840 million for the fourth quarter. Sounds good, right? But here's where the story gets interesting. The market still reacted negatively, with the stock taking a 7.4% hit. Why?

The market’s reaction wasn't about the headline numbers; it was about the cost of those numbers. Capital expenditures jumped to $70 million for the quarter, a huge leap from the $110 million spent in the first half of the year. That kind of spending raises serious questions about future profitability. Are they having to spend more to get the same growth? And if so, is this sustainable?

And this is the part of the report that I find genuinely puzzling. The company authorized a $500 million share repurchase program. Now, I’m not against buybacks in principle, but spending that kind of cash when your capital expenditures are already spiking seems… shortsighted. It's like using your credit card to buy lottery tickets while also maxing it out on essential bills. Are they trying to artificially prop up the share price, or do they genuinely believe the stock is undervalued? I am leaning towards the former.

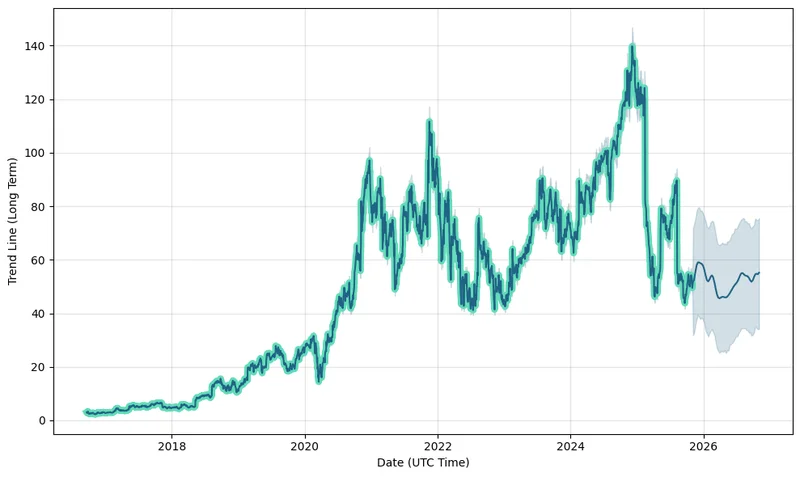

The Trade Desk is down 63.7% since the start of the year, trading nearly 70% below its 52-week high. Ouch. That means investors who bought $1,000 worth of shares five years ago are now looking at an investment worth $560.98. That's not exactly a ringing endorsement.

Analysts, of course, are still trying to paint a rosy picture. Susquehanna just set a price target of $85.0. Rosenblatt is at $64.0, Needham at $60.0. But the median target from 22 analysts over the last six months is only $66.0. There's a wide range of opinions, which suggests a lack of consensus and, frankly, a lot of uncertainty. New Analyst Forecast: $TTD Given $85.0 Price Target

And let’s talk about those price targets for a second. How much weight should we really give them? Analysts are often incentivized to maintain positive ratings, even when the data suggests otherwise. It's a classic case of "don't bite the hand that feeds you."

Here's another red flag: Congressional members have been actively selling TTD stock. Insiders have also been selling. The Chief Legal Officer sold over 51,000 shares, and the CEO sold nearly 30,000. Now, insider selling isn't always a bad sign (people have expenses, diversification strategies, etc.), but when you see this level of activity, it raises eyebrows. It suggests that those with the most intimate knowledge of the company's prospects are choosing to reduce their exposure.

The Trade Desk's shares are very volatile. There have been 28 moves greater than 5% over the last year. That kind of volatility isn't typical of a mature, stable company.

The Trade Desk still has a lot to prove. The market is starting to question the sustainability of its growth and the wisdom of its spending. The analyst targets are all over the map, and insiders are heading for the exits. The data is telling a story, and it's not a particularly optimistic one. The share buyback program seems like a band-aid on a much deeper wound. I would stay away.